In today's complicated financial environment, accurate VAT computations are vital now more than ever to businesses regardless of their size. With VAT rules evolve and compliance requirements intensify, companies encounter significant challenges that can affect their profits if not managed correctly. The importance of precise VAT calculations goes further than simply maintaining compliance; it plays a crucial part in ensuring that do not overpay or underpay their taxes, which may result in legal complications as well as financial losses.

Utilizing a dependable VAT calculator may streamline the procedure, making it more straightforward for companies to manage the intricacies of tax regulations. Equipped with the right tools and knowledge, companies can make well-informed choices that enhance their monetary well-being. Understanding the urgent need for accurate VAT calculations remains crucial, not only in terms of preventing fines, but also promoting expansion as well as longevity in a competitive environment. As businesses strive for effectiveness, the implications of VAT computations are extensive, making it a fundamental component of financial management.

Comprehending Value Added Tax and Its Calculations

VAT, frequently referred to as Value Added Tax, constitutes a sales tax imposed on items and services at each stage of production and delivery. Companies collect VAT from customers at the point of purchase, which then needs to be transferred to revenue authorities. Accurate calculation of VAT is crucial not only for compliance with tax regulations but also for ensuring a robust cash flow. Inaccuracies can lead to financial penalties and damage to a company's reputation.

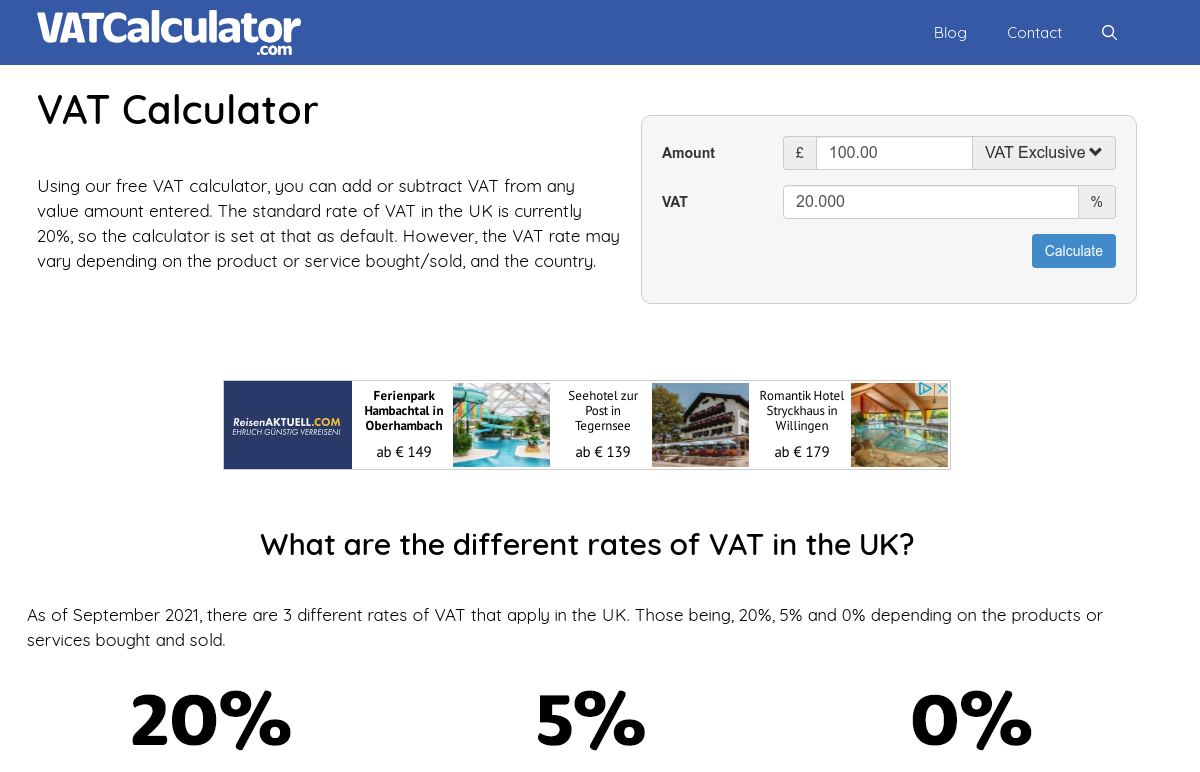

Calculating VAT in calculating VAT involves determining the right rate applicable to the goods or offerings provided. This can change based on the area and character of the product. Using a trustworthy VAT computation tool can simplify this calculation, providing companies with a fast and efficient way to calculate the VAT due on transactions along with buying. Guaranteeing conformity to these figures helps in avoiding errors that could result in expensive audits.

Businesses should also reflect on the consequences of different VAT rates, including lowered rates for certain goods and the exceptions that may apply. Comprehending these aspects is key to effective financial administration. Inaccurate VAT calculations can not only impact a company’s bottom line but also obstruct growth chances when finances are mismanaged. Being vigilant about VAT computation protects firms from unforeseen problems and guarantees they stay viable in the industry.

Common Issues in VAT Calculations

One of the most common mistakes in VAT calculation arises from misclassifying goods and services. Different items can be subjected to various VAT rates, and misunderstanding these categories can lead to substantial errors. For example, a firm might incorrectly apply the default rate instead of the lower rate, resulting in excessive charges customers or missing out on recoverable VAT. To lessen this risk, businesses should always refer to their local tax authority or use a reliable VAT calculator to ensure they are applying the correct rates.

Another common error is not managing to keep accurate and detailed records. Proper documentation is essential for VAT compliance and calculations accuracy. Many businesses neglect to track all their transactions meticulously, which can lead to discrepancies when filing VAT returns. Incomplete records can not only result in wrong VAT calculations but can also attract penalties during audits. Using a VAT calculator can help simplify this process, guaranteeing that all relevant data is considered in the calculations.

Finally, businesses often fail to recognize the importance of being updated with evolving VAT regulations. Tax laws can evolve, and neglecting to adapt can lead to errors in calculations. For instance, changes in VAT rates or fresh exemptions may occur, and businesses that do not modify their calculations accordingly could face compliance issues. Periodically updating legislative updates and using modern tools like a VAT calculator can help businesses remain compliant and accurate in their VAT obligations.

The Necessity of Employing a VAT Calculator

Utilizing a VAT calculator is crucial for organizations to ensure precise tax reporting and adherence. These tools streamline the process of computing value-added tax, aiding companies steer clear of blunders that can lead to financial penalties. With VAT rules changing by region, a trustworthy calculator can provide the necessary adjustments based on the latest tax rates and rules, allowing it more straightforward for companies to stay updated.

Moreover, a VAT calculator helps optimize economic processes. By streamlining the math, organizations can save time and reduce the risk of human error. This effectiveness enables more concentration on other critical areas of operations, ultimately leading to improved productivity. As businesses grow and transactions become complicated, the ability to swiftly and correctly compute VAT becomes ever important.

Lastly, employing a VAT calculator can enhance financial transparency and decision-making. With precise VAT figures, companies can more effectively analyze their cash flow, pricing strategies, and overall monetary health. vat calculator in strategic planning but also builds trust with stakeholders, including clients and suppliers, who expect correct financial dealings. Overall, the implementation of a VAT calculator is a critical step for any business committed to maintaining fiscal responsibility and compliance.